Insights on the Economy: Our 2024 Global Market Outlook

The economic distortions of the past few years have produced tectonic shifts in the global investment landscape. The massive fiscal stimulus and near‑zero interest rates seen during the pandemic have given way to tighter monetary policies and sharply higher bond yields.

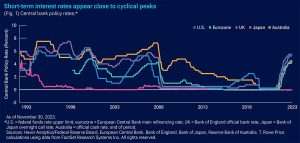

While the U.S. Federal Reserve and other major central banks have made progress against inflation and policy rates appear close to their peaks (Figure 1), our analysis is that the Fed is likely to hold rates steady in 2024.

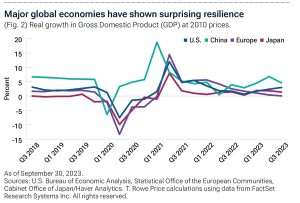

Monetary policy effects typically are felt with a lag, so global economic growth remains at risk. The eurozone already is in recession, and China’s post‑pandemic recovery has been disappointing. However, the U.S. economic outlook is more encouraging, as corporations and consumers both have proven less sensitive to higher rates compared with other major global economies. Fiscal stimulus has added further support.

Bond volatility moves to the long end

Uncertainty is likely to keep fixed income volatility high in 2024. But if major central banks remain on hold, volatility is likely to move to the long end of the yield curve, as opposed to the sharp moves seen at the short end as central banks tightened. Surging U.S. Treasury issuance also could keep upward pressure on longer‑term yields.

Attractive yields should support below investment‑grade (IG) corporates, with improved credit quality helping keep defaults relatively low. Shorter‑term IG corporates also appear to offer opportunities. Careful attention to issuer fundamentals will be critical.

Looking beyond the tech giants

The global equity rebound in 2023 was dominated by a handful of mega‑cap U.S. technology stocks. But positive fundamentals in some regional markets and innovations in other key sectors should help expand the opportunity set in 2024.

Health care innovation is one area that could offer opportunities, as could the energy sector, thanks to capital investment in both traditional and renewable energy sources. Commodity‑related sectors appear to have bottomed and could be attractive hedges if inflation proves stickier than expected.

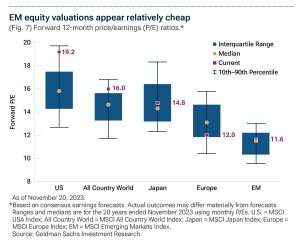

Emerging market (EM) equities are attractively valued relative to developed markets. We see selective opportunities in China, despite sluggish economic growth. Within the developed markets, structural and cyclical factors should be supportive for Japanese equities.

The COVID pandemic and the subsequent recovery continue to distort the economic data, forcing economists who rely on traditional recession signals to continually revise their assumptions. As a result, the most anticipated global recession in history has become the most delayed recession in history.

…the most anticipated global recession in history has become the most delayed recession in history.

To be sure, there are reasons for caution regarding the global economic outlook. Europe looks likely to endure stagnant growth in early 2024 before recovering in the second half. In Asia, China’s economic outlook remains gloomy, with few signs of improvement in the country’s property market. Commercial real estate sectors remain fragile in several other countries as well.

Meanwhile, the U.S., Japan, and Europe are at different stages in the balance between growth and inflation, meaning the Fed, the European Central Bank, and the Bank of Japan (BoJ) are likely to pursue increasingly asynchronous monetary policies in 2024, adding to the potential for increased market volatility.

Geopolitical uncertainty also could bring further volatility, particularly if conflicts in the Middle East and Ukraine cause a resurgence in energy prices. Recent election victories for far‑right populist candidates in Argentina and the Netherlands raise the question of whether further wins for populist parties could occur elsewhere, especially in the U.S., where the November 2024 election will be the most consequential currently known political event of the year.

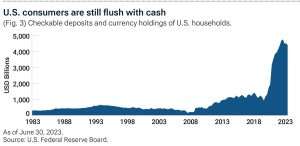

As of late November 2023, most global economies were showing surprising resilience to higher rates (Figure 2), and the U.S. economy was performing better than expected. The unprecedented levels of cash generated by pandemic support and other fiscal stimulus measures have been a key support for U.S. household and corporate balance sheets. Excess consumer savings should continue to provide support for U.S. economic growth going forward

Consumer spending has been the most resilient driver of growth, due to the strength of the U.S. labor market. At the end of September 2023, there were 9.6 million open jobs available for the 6.4 million unemployed workers in the U.S. labor force.

Dealing with regime change

Even if the U.S. economy remains resilient in 2024, we believe investors will need to adapt themselves to a new market regime. To understand the implications of this shift, it is useful to examine the four historical regimes that U.S. markets have experienced since 1955, after the distortions created by World War II and the Korean War had largely dissipated.

While the post‑pandemic regime may not align perfectly with any of these prior periods, it will include some factors that prevailed during those regimes. Given the shift away from the structural forces that supported disinflation and lower rates in the wake of the 2008 global financial crisis (GFC), a return to the post‑GFC “new normal” strikes us as the least likely outcome going forward.

Heading into 2024, inflation risks are skewed to the upside. Energy prices are a concern amid supply‑side pressures. As of third quarter 2023, U.S. wages were still growing at almost a 4% annual rate. If U.S. consumer inflation changes course and reaccelerates while economic growth remains anemic, the risk of stagflation will rise considerably.

Which regime is most likely to prevail in 2024? Recent readings for the fed funds rate and inflation have been closest to the pre‑GFC “old normal.” But the regime second closest to recent conditions isn’t stagflation, it’s the postwar boom.

It remains to be seen how real (after‑inflation) interest rates above 2% will play out in the markets. But we do not believe that high rates will kill the U.S. economy. Rates are high relative to the post‑GFC period, but not relative to capital market history. The federal funds rate exceeded 5% for decades and stock markets still did well. Sticky inflation historically has been good for earnings.

Neutral on risk assets

Despite the macroeconomic uncertainties, we see no reason for investors to be excessively bearish. Market segments that don’t trade at nosebleed valuations, such as small‑ and mid‑cap stocks and real assets equities, look appealing on a relative basis. If we see a spike in volatility and a market sell‑off, it could be an opportunity to buy stocks.

…we see no reason for investors to be excessively bearish.

However, we also don’t think this is the right time to take large tactical allocation bets. The recent “dis‑inversion” of the U.S. yield curve could augur volatility in both stocks and bonds in the months ahead. We think the best approach heading into 2024 is to remain broadly neutral on risk assets, including equities.

With U.S. interest rates closer to their historical averages, a balanced portfolio could offer diversification benefits¹ as bonds now provide higher income and ballast to stocks. However, interest rates are likely to remain volatile in 2024, so we favor maintaining an overweight to cash or short‑term bonds. These assets currently offer attractive yields with minimal duration² exposure and could be potential sources of liquidity if market opportunities arise.

For investors looking beyond the traditional 60/40 stock/bond portfolio, and willing to take on more risk, we also favor alternatives with lower correlations to traditional assets and to areas of the market that could benefit from market dislocations and higher yields, such as private credit.

The massive tightening of financial conditions since late 2021 has produced a fixed income market vastly different from the stimulus‑fueled environment during and following the pandemic. The cross‑currents generated by these changes will challenge investors again in 2024.

Heading into the year, we think the best way to describe the macro environment is that we have reached or passed peak everything—inflation, liquidity, fiscal support, China growth, housing, credit availability, and labor market strength. In other words, most of the one‑off tailwinds that defined the post‑pandemic environment are fading away.

Although global economies—the U.S. economy in particular—have held up relatively well so far despite higher rates, a hard economic landing is not out of the question, especially following the spike in bond yields. Even if a recession is

avoided in 2024, we are likely to see economic growth concerns intermittently elevated.

Higher for longer

As of late November, futures markets were pricing in four Fed rate cuts in 2024, anticipating that the U.S. central bank will ride to the rescue if the U.S. economy falls into recession. However, we believe the failure of the Fed and most other developed market central banks to get ahead of inflation following the pandemic makes them more likely to keep policy rates at relatively high levels through much of 2024.

Structural forces such as deglobalization, lower labor force participation rates, and energy price pressures also could make inflation stickier than in past

economic slowdowns, further discouraging central banks from easing monetary policy.

Of course, a major episode of financial volatility could prompt monetary policymakers to look beyond stubborn inflation and cut rates or pause quantitative tightening—the contraction in central bank liquidity as bonds purchased in pandemic stimulus efforts are allowed to run off their balance sheets.

Potential “canaries in the coal mine” warning of such a correction might include a more severe banking crisis, a collapse in commercial real estate, a significant sell‑off of the mega‑cap tech stocks that led U.S. equity markets higher in 2023, or deteriorating conditions in private equity markets.

However, our base‑case outlook is that central banks will remain on hold for an extended period into 2024. This stance is likely to shift volatility to the longer end of the yield curve, as opposed to the exaggerated upward moves in shorter‑term rates seen as the Fed tightened in 2022 and early 2023.

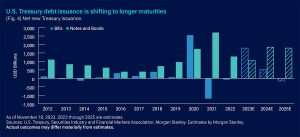

Sovereign issuance is surging

With fiscal deficits ballooning, we expect governments to continue flooding the market with new sovereign debt. This is particularly true in the U.S., where the Treasury is shifting the bulk of new issuance away from short‑term bills and into longer‑term notes and bonds.

This issuance shift is the basis for one of our highest‑conviction calls: that yield curves will steepen in 2024. Although yields on high‑quality sovereign debt may have peaked in late 2023, they still could move higher. Accordingly, we think curve steepening is likely to be a more significant factor than the outlook for interest rate levels.

Another implication of the surge in government bond issuance is that it could crowd corporate borrowers out of the market—or at least force up their funding costs. This could make companies less likely to spend on capital projects or hire more employees, reducing support for the global economy.

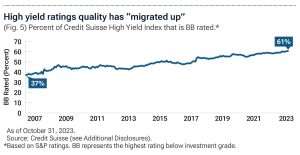

High yield credit quality has improved

Looking more closely at the corporate bond market, attractive yields should continue to support demand for high yield bonds, even though credit spreads—the yield differences between bonds with credit risk and high‑quality government bonds with similar maturity dates—appear less compelling, trending near historical averages as of late November.

Obtaining attractive yields doesn’t require investors to accept as much credit risk as in the past….

Obtaining attractive yields doesn’t require investors to accept as much credit risk as in the past because the quality of the high yield bond universe overall has improved.

We also see attractive opportunities in shorter‑term IG corporates. While these instruments carry some credit risk, short maturities reduce their exposure to an economic downturn. As of late November, shorter‑term corporates provided a meaningful yield premium over money market funds and bank savings deposits,³ leaving investors better positioned if short‑term rates decline in 2024.

Going into 2024, credit spreads on longer‑term IG corporates aren’t wide enough to compensate for the additional risk stemming from their extended maturities, in our view. However, spread widening could create more attractive opportunities in these bonds as the year progresses.

We expect correlations between returns on high‑quality sovereign debt and the performance of risk assets such as equities and corporate bonds to remain volatile as markets adjust to the new environment of higher interest rates and as

global economic growth decelerates. However, we believe duration exposure should reward investors in the event of major downturns in equities and credit.

Non‑core fixed income assets, such as high yield or EM bonds, also should provide diversified sources of return even if equities perform well or move in a sideways trend.

In 2023, many investors seemed inclined to wait for a clear peak in yields before meaningfully raising their fixed income allocations. In 2024, we think a more attractive option will be to take advantage of some of the highest yields available over the past two decades in many fixed income sectors. As always, in‑depth analysis of credit fundamentals—for both IG and high yield issuers—will be essential.

Global equity markets are likely to remain challenged in 2024 as the world transitions to a regime of higher trend inflation and interest rates. This transition could generate shifts in earnings growth expectations, triggering volatility. Close attention to risk management will be needed.

On the plus side, broader, less concentrated market leadership is likely to provide more varied sources of returns for investors who maintain a sharp focus on valuation fundamentals.

Although U.S. equity valuations appear more reasonable, they continue to face stiff competition from attractive yields on money market and short‑term fixed income assets. This suggests a need to look for pockets of attractive relative valuation.

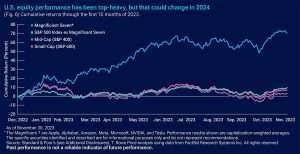

Global equity performance in 2023 was predominantly driven by the so‑called “Magnificent Seven” mega‑cap U.S. technology stocks (Figure 6), propelled by their above average earnings performance and rising expectations for artificial intelligence (AI) applications. Through November, the Magnificent Seven stocks collectively were up over 70% for the year to date on a capitalization‑weighted basis. The remaining 493 stocks in the S&P 500, on the other hand, rose less than 9.5% (Figure 6). Such highly concentrated markets increase risk, particularly for investment strategies measured against benchmarks that require them to maintain exposure to these outsized positions.

Stretched valuations, produced by their strong performance, leave the U.S. tech giants vulnerable to mean reversion—the historical tendency for periods of above‑average performance to be followed by subpar returns. Accordingly, we believe mega‑cap tech leadership is likely to fade in 2024 as the opportunity set broadens.

Regional opportunities

We continue to favor EM equities over developed equities as relatively attractive valuations (Figure 7), upside earnings potential, and the possibility of incremental fiscal and monetary stimulus generally are more supportive for the EMs. A shift away from highly centralized global supply chains also could favor the EMs. Potential beneficiaries include Malaysia, Indonesia, Brazil, and Chile.

Within the developed markets, near‑term prospects for European equities look less attractive relative both to other developed markets and to the EMs. As the business cycle rolls over, demand is likely to weaken and profit margins could come under pressure. Companies with more robust margins are likely to navigate this environment more effectively but also will sell at higher valuations.

As Europe approaches a business cycle recovery that is likely later in 2024, further opportunities should arise in those markets, where valuations overall are likely to still be reasonable.

Japanese equities continue to look relatively attractive. The Japanese yen appears undervalued and will likely appreciate should the BoJ change its monetary policy. While a stronger yen historically has been seen as a negative for the export‑driven Japanese economy, its potential impact going forward is unclear given the positive momentum and potential for repatriated flows by domestic investors. For foreign investors, however, Japan has the triple merits of reasonable valuations, a cheap currency, and structural reform.

…we believe AI has the potential to enhance productivity across a wide range of sectors and companies.

The growth outlook for China is less positive, as efforts to stimulate demand so far have been relatively ineffective. Beijing’s decision to allow its 2024 budget deficit to exceed 3% of GDP was a step in the right direction, but it’s not clear whether policymakers will go further. This uncertainty is reflected in relatively low valuations in China’s equity markets.

While the direction of economic growth in China is uncertain, excessively negative sentiment could produce selective equity opportunities in 2024 in sectors benefiting from the technological upgrade of China’s industrial base, including electric vehicles, semiconductors, and higher‑value industrial products.

Key sector themes

Technology/AI:The extent to which richly valued U.S. tech giants can demonstrate clear benefits from AI may influence how much pressure they come under in 2024, as these firms race to acquire new capabilities and refine existing ones. But, in contrast to the internet boom of the 1990s, when a relatively small number of firms reaped the bulk of the benefits, we believe AI has the potential to enhance productivity across a wide range of sectors and companies.

Attractive opportunities could include semiconductor companies that are developing leading‑edge chips, tech service firms that help companies scale and enhance their AI capabilities, and data centers that benefit from increased demand.

Health Care: Innovation—from bioprocessing to medical devices to new treatments for obesity—also could generate significant equity opportunities in 2024. The U.S. Food and Drug Administration’s approval of a class of diabetes medications for use as weight‑control drugs has the potential not only to change patient outcomes, but to remake health care economics, given that obesity is a contributing factor to many other conditions. These advances also could have longer‑term implications for the food, retail, and hospitality sectors as structural patterns adapt.

Energy and Commodities:Energy and other commodity‑related stocks could prove to be attractive hedges in 2024 if inflation is stickier than expected and/or if geopolitical factors trigger another energy price shock. These sectors also could be a major focus for investors as countries and firms push ahead with decarbonization programs. Many EMs are heavily concentrated in energy and commodity‑related sectors, so these markets should benefit if renewable energy projects fuel a capital spending boom.

The longer‑term outlook for commodity producers could improve as prices adjust upward due to peaking productivity and higher production costs. Geopolitical risks also are likely to keep energy prices high even as supply expands—with positive implications for industry profitability.

These factors do not necessarily mean that global commodities are entering a new bull market, but do imply that we may be past the trough of the long‑term cycle.

Resource: GWFM Research & Study