New report details the latest rankings of the top providers.

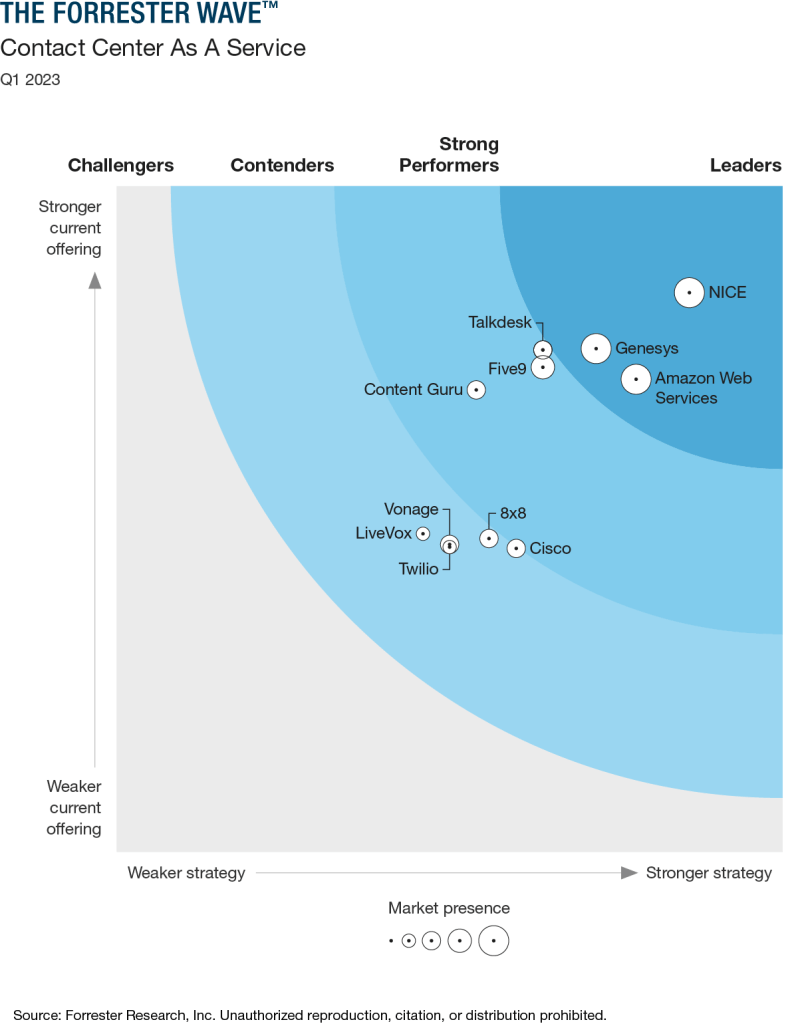

The results are in! NICE is named a leader in The Forrester Wave™: Contact Center As A Service, Q1 2023 report evaluating top provider’s current offering, strategy, and market presence.

We believe this highlights our:

- Relentless focus and experience with AI for customer experience

- Key investments in leading digital and self-service interactions

- Unique breadth of cloud-native services on a single platform

NICE received among the highest scores in “performance,” “product vision,” and “innovation roadmap” criteria.

Read the report for valuable insights, including:

- Advice on moving to the cloud

- Guidance on evaluating current CX systems

- Information on how to leverage the latest cloud technologies to improve CX and reduce costs

CCaaS Is No Longer Just A Better Way To Do What We Have Always Done

We stopped producing premises-focused contact center Forrester Wave™ evaluations more than six years ago, when CCaaS was not just the future but a major market presence. Events since then have validated our research; there is no going back. When COVID-19 sent contact center agents home, the flexibility and agility of CCaaS systems dramatically eased the pain of this change, cementing the technology’s role as the norm for resilient contact centers. Meanwhile, CCaaS has morphed into its own beast — it is no longer just a cloud-based copy of premises-based systems. CCaaS systems make advanced customer service practical. They simplify omnichannel communications, provide critical customer data on the agent desktop, and tightly integrate with workforce optimization (WFO) tools to

- Have a comprehensive approach to integrating AI. AI is not a standalone feature; it enables a core set of CCaaS functions that improve customer interactions. It is early days for AI in the contact center, and different vendors approach this technology differently, but the benefits of key AI capabilities are consistent. Conversational AI opens the door to self-service solutions that were previously inconceivable. Conversation intelligence improves agent performance by making helpful suggestions at runtime and making quality management tools smarter. Over time, conversation intelligence will interpret customer conversations to help brands improve customer experiences across the entire organization, not just in customer service.

- Provide a broad, tightly integrated suite. Given that the average contact center director manages 20 vendor relationships, contact center buyers want as much breadth from their solutions as possible. Each of the vendors in this evaluation provides a mix of capabilities much broader than what is available from traditional contact center offerings. The list of capabilities includes workforce management, call recording, AI-driven quality management, digital customer service, and complex analytics.

- Can make it personal. Leading CCaaS vendors capture and employ critical customer information to allow highly personalized experiences. Conversational AI systems can use this customer insight to make self-service applications smarter and more efficient. Agents are better able to provide focused, empathetic service when the full customer interaction history is right on their desktop. Combining AI with detailed customer interaction data enables smarter recommendations on how to approach a customer during a challenging interaction or how to identify the right time to try an upsell.

- NICE differentiates by targeting AI across the full customer experience. NICE’s acquisition of InContact in 2016 combined leading companies in the CCaaS and WFO markets. Its solid execution since then has created a company with unique breadth to serve contact centers globally. NICE has a superior vision that extends beyond improving agent efficiency. The company looks to play a role in the entire CX journey. It’s executing on this vision with a strong roadmap that features AI and an accelerating focus on digital interactions. This shift in focus requires a fundamental shift in the company’s sales and marketing strategies. NICE needs to ensure it stays focused on its core contact center customers while it expands to deliver on this larger CX positioning. NICE has a significant R&D budget and is investing in infusing AI into analytics and agent assistance, WFO, conversational AI, and many other places.

- NICE also differentiates with the breadth of its capabilities. It has a comprehensive solution for whatever WFO or CCaaS system a contact center leader may need. NICE’s products are not microservices-native. While it has made significant investments in moving its product stack in that direction, that journey continues. Forrester did not speak with any reference customers. With its breadth of functionality, NICE is a strong fit for contact center managers and brands looking to provide positive experiences across the entire customer journey.

- Amazon Web Services’ Connect product is now worthy of the company’s brand. Amazon built itself a large customer service contact center, which the company used as a model for its own CCaaS offering in 2017. Six years in, Amazon Web Services (AWS) has become a Leader by combining its massive market clout with an ever-maturing product. In many ways, AWS just smothers the market: It has sales relationships with IT teams around the world and backs those up with contact center experts. Its pace of innovation is faster than others in this evaluation. Working with Amazon isn’t always easy. For example, its usage-based pricing is a fair way to charge for value but provides the type of variability that causes heartburn for many organizations. Amazon Web Services is continuing its significant investment in Connect, building out in four product areas: omnichannel, analytics, agent productivity, and self-service configuration.

- Amazon Web Services now approaches functional parity with the leading companies in the space, riding on a modern architecture with access to many AWS tools and resources. Connect is still rough around the edges, and compared to many others in this evaluation, more development work is required to stand the product up. Reference customers called Amazon Web Services a good partner to work with and lauded its AI capabilities. Companies willing to invest some development resources into Connect will get good results from their contact center.

- Genesys offers a broad set of capabilities — and an even broader vision. Genesys has been a longtime player in the contact center space. It is one of the few vendors to successfully navigate from premises-based offerings to thrive in the cloud. Genesys provides a wide-ranging set of product capabilities and a go-to-market engine that successfully sells around the world. Its superior vision can take it beyond the contact center and into all customer interactions. The company recently dropped its multicloud product line. While the pressure of selling and supporting multiple product lines was problematic for the company, this change diminishes its differentiation at the highest end of the market and will force some of its largest customers off a platform that uniquely meets their needs. Genesys has numerous data centers and support staff around the world, with plans for data center expansion. It’s also planning to extend its WFO capabilities to make them a standalone offering in the contact center or across an enterprise.

- The Genesys suite boasts an impressive breadth of functionality, with powerful customer journey analytics from its acquisition of Pointillist and comprehensive WFO capabilities. Genesys is still evolving its omnichannel support, as evidenced by its multiple agent desktops. Reference customers were happy with the 100% uptime and the frequent updates and enhancements. References also spoke of challenges they faced with their deployments and difficulties finding the right resource in support. Genesys makes a great fit for any brand needing expansive contact center capabilities at scale.

- Talkdesk has a modern platform and vision, but some new functions continue to mature. Talkdesk built its solution on a microservices core, which it takes advantage of to add functionality quickly. Talkdesk just keeps growing, as it has moved up in the market and expanded globally. Its products are growing as well, with ever-expanding AI offerings and WFO tools introduced in 2020. Talkdesk is enjoying early success with its vertical solutions that it started releasing in June 2021. The company will continue to invest in its vertical offerings, which it sees as an important differentiator going forward. The roadmap includes plans to add to its AI capabilities and a focus on faster time to value.

- Talkdesk provides a good set of AI solutions and a pleasing and powerful agent desktop. Much of what Talkdesk builds is downright elegant. For example, its configuration tool for CRM integrations greatly simplifies the integration process. But it needs to make investments in ensuring that new capabilities are ready for release — customer references reported challenges with newly released capabilities, including email and ticket handling. Talkdesk’s native workforce management, performance management, and gamification capabilities fall short of those of Leaders. Reference customers gave the company kudos for its speed of innovation, AI capabilities, and agent desktop. US-based customers struggled on support issues when working with experts in Europe. Brands in the healthcare, financial services, and retail industries should consider Talkdesk, and midsize-to- large brands looking for a modern system with a full set of capabilities need to put the company on their list.

- Five9 is an industry stalwart with AI strengths but less vision beyond the contact center. Five9 has been a key player in the CCaaS market for over 20 years. It has expanded from its roots as a dialer company and now offers a broad portfolio of capabilities. The company focuses on AI to help solve new and bigger challenges in the contact center. It has a strong partner approach, with over 70% of its deals partner-influenced. Five9’s international revenue lags its investments outside of North America. Its focus is narrower than that of Leaders, with less of a view to addressing issues beyond the contact center. Roadmap priorities include enhancing insights and reporting capabilities and embedding AI into more of its offerings. Five9 has a flexible approach to AI with its own intelligent virtual assistant (IVA), as well as productized integrations to several AI engines. By combining a strong customer “data lake” with AI, Five9 can provide agents with information to help personalize customer experiences. It also boasts strong reliability and a global presence. Five9’s incorporation of the Inference IVA is still a work in progress and requires separate data centers and development tools. Its workforce management offering isn’t the best fit for contact centers with over 500 seats, and it will resell Verint in cases where it makes sense. Reference customers praised the ease of deployment and the quality of the support team. Some reference customers identified issues with support in Asia as well as for Verint solutions. Five9 is a good fit for medium-to-large contact centers interested in AI and a broad portfolio of capabilities on a mature and reliable platform.

- Content Guru offers a strong solution built with an old-school approach. Based in the UK, Content Guru sells Storm, its CCaaS offering, across Europe and Asia, as well as in North America, where it has a significant presence selling into the US government. Content Guru has a solid vision of offering omnichannel and “omnidata” (providing a customer database platform) solutions to enhance the customer experience in the contact center and beyond. Content Guru is less aggressive in embracing microservices and public cloud hosting than other vendors in this evaluation. The company’s R&D spend is low among vendors in this evaluation, but it is executing on its vision of meeting the digital channel shift, providing a customer data platform and intelligent automation.

- The Content Guru solution provides high reliability and inbound and outbound interactions across a high number of channels. The product’s flexibility allows it to fit into many environments and serve many scenarios. Content Guru takes a vendor-agnostic approach to AI, focusing on making it easy to use any third-party AI engine. Customers praised Content Guru’s product for its maturity and broad functionality. They also praised the company as a good partner to work with but said licensing and provisioning changes were challenging. Content Guru is good for medium-to-large enterprises and multinational corporations that care about high availability and scalability and have complex functional requirements.

- Cisco has an exciting new offering, but it’s early days for the product. Cisco has been in the contact center space for decades and released Webex Contact Center in November 2021. The product has a solid microservices core, but it is new, and it will take time to reach feature parity with the Leaders in this report. Cisco has a laudable vision for the product: customer data and AI available on a modern infrastructure that is part of the larger Cisco communications infrastructure. Cisco’s global market presence, massive partner ecosystem, and strong IT relationships will get the product in the hands of many brands quickly. It will take time for Cisco’s offering to catch up to other vendors that have a multiyear head start on it. Cisco’s roadmap includes adding AI capabilities and expanding its global presence with more data centers. However, a big part of its current roadmap is about playing catchup.

- Cisco’s offering sits on a solid microservices platform, which will help it take advantage of the company’s many strengths, particularly AI and unified communications (UC). There are some notable holes in this young offering. Among other things, Cisco needs to consolidate its separate voice and digital development environments and enhance its outbound capabilities and WFO options. Reference customers were happy to have their UC and contact center (CC) offerings on a single platform and found the system easy to manage. Integrations with Cisco’s communications platform as a service (CPaaS) system and Google’s contact center AI (CCAI) platform were difficult to set up. Brands that have a relationship with Cisco should give Webex Contact Center a good look.

- 8×8 delivers global UC and CC solutions but has limits on scale and functionality. 8×8 started as a UC company and added a contact center solution in 2013 to broaden its portfolio. Its CC solution is designed for ease of use and takes advantage of its global telephony network. 8×8 has global success thanks to its international telephony presence. The company continues to improve its UI and makes it easy for brands to manage and use the contact center system. The advantage of 8×8’s simplicity-first approach fades in deployments with over 500 seats. Contradictorily, its ability to deliver a global contact center presence is most valuable at a scale higher than 500 seats. The company is focused on the user experience across the board — adding new UIs for supervisors, administrators, and other users across an enterprise. 8×8 is also looking to build out its AI for self-service applications.

- The reliable 8×8 network delivers industry-leading uptime for its customers. 8×8’s dedication to making the product simple reduces agent training time and simplifies system management. The company has infused AI into its quality management capabilities to good effect and uses AI to enhance business insights. Other AI-driven functions, like chatbots or agent assist, are heavily dependent on partner capabilities. Beyond quality management and speech analytics, 8×8 relies on partners for WFO capabilities. Reference customers found the product easy to learn and use. They also cited system migration and the initial deployment as challenges. 8×8 best fits brands that value having their CC and UC capabilities from the same provider. Its sweet spot is in the sub-500-agent-seats range.

- Vonage’s CC, UC, and CPaaS shine together, but its CCaaS fades without Salesforce. Vonage is a story of acquisitions. It acquired Nexmo in 2016 for CPaaS and then added CCaaS to its unified communications as a service (UCaaS) capabilities by acquiring New Voice Media in 2018. Vonage was then acquired by Ericsson in 2022. The Ericsson acquisition gives Vonage new routes to market and to accelerated R&D spend. Vonage has focused on deep Salesforce integration as a differentiator, giving it a strong position within the Salesforce ecosystem. Vonage falls short on its CCaaS vision for non-Salesforce customers, as many of its advantages come directly from that integration, such as the analytics embedded within Salesforce. Vonage’s roadmap focuses on further expanding its openness and integrations footprint across CRM and collaboration tools. Its plans also include extending AI capabilities and strengthening analytics.

- Twilio needs to become more than a builder’s paradise to deliver its exciting vision. Twilio’s CPaaS provides a builder’s paradise for communications. The Flex product is a strategic imperative for Twilio, a builder-first CCaaS platform utilizing the company’s CPaaS offering. Twilio’s recently acquired Segment customer data platform points to an exciting CX vision that spans far beyond the contact center. Flex is a key piece of that vision. But the company has a lot of work to do on its innovation roadmap to fill in product gaps relative to others in this evaluation. The company’s roadmap focuses on this need, prioritizing out-of-the-box capabilities to speed up time to value and enhancing both WFO and AI functionality. Deeper integration with Segment is also critical.

- Flex runs on a modern, microservices architecture with APIs that allow it to fit any environment. Its flexibility works for traditional contact centers, sales, and other customer-facing organizations. The product’s flexibility and extensibility are strengths for brands with the resources to take advantage of them. The product is less mature out of the box, limiting its appeal to brands looking for a more complete offering. Reference customers loved the product’s flexibility and spoke highly of Twilio’s support services. They identified limited capabilities out of the box and the complexity of supporting a bespoke solution as concerns. Brands that have the developers needed to take advantage of Twilio’s flexibility are the obvious target for Flex today. As Flex evolves, Twilio will work to expand its appeal to less development-oriented contact centers and beyond.

- LiveVox is simple to manage and use, sometimes at the expense of flexibility. LiveVox started as a provider of tools for outbound calling applications. It has evolved into an all-in-one contact center offering that is sold primarily in North America. The company’s goal is to deliver sophisticated contact center tools in a manner that is easy to use and administer and provides a quick time to value. The company has a relatively narrow focus, selling only in North America with minimal investment in partner or vertical strategies. This narrow focus limits its market opportunity. LiveVox is exploring ways to expand its international readiness, both in the product and as an organization. The company is also focused on increasing ease of use and adding real-time agent assistance.

- LiveVox includes an internal CRM system that makes customer data easily accessible for integrations, routing decisions, and the agent desktop. Reporting, dashboards, and analytics are strengths as well. LiveVox’s solution is not as extensible as other options, and it depends on partners for workforce management. The company’s performance management and gamification capabilities are relatively limited. The product’s scalability is more limited than similar vendors. Reference customers enjoyed the speed with which they were able to deploy solutions but were concerned about the lack of visibility into the full customer journey across different channels. North American-based brands with small-to-midsize contact centers looking for a straightforward solution that provides quick value should consider LiveVox.

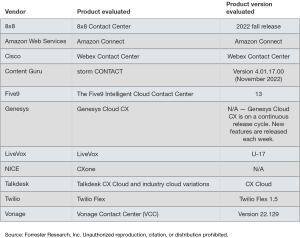

Evaluation Overview

- Current offering. Each vendor’s position on the vertical axis of the Forrester Wave graphic indicates the strength of its current offering. Key criteria for these solutions include omnichannel interaction routing, platform/core architecture, integrations, outbound capabilities, WFO tools, vertical capabilities, customer self-service, data management, reporting and dashboards, developer support, and agent desktop and tools.

- Strategy. Placement on the horizontal axis indicates the strength of the vendors’ strategies. We evaluated market approach, performance, partner ecosystem, supporting products and services, product vision, innovation roadmap, and commercial model.

- Market presence. Represented by the size of the markers on the graphic, our market presence scores reflect each vendor’s number of customers, product revenue, and number of agent seats.

- A strong focus on CCaaS. At least 50% of the vendor’s usage is via inbound voice interactions.

- Critical components of a cloud contact center solution. These include interaction routing, IVR, an agent desktop, reporting and analytics, and supervisor tools as well as WFO capabilities.

- Significant revenue from its CCaaS offering. The vendor must be able to support agents from multiple different geographic regions. If a vendor only sells to a single geographic region, the revenue requirements will be higher.

- Garnered mindshare among Forrester clients. The vendor is frequently mentioned in the context of inquiry, briefings, and consulting engagements for CCaaS solutions.

In our review, we conduct primary research to develop a list of vendors to consider for the evaluation. From that initial pool of vendors, we narrow our final list based on the inclusion criteria. We then gather details of product and strategy through a detailed questionnaire, demos/briefings, and customer reference surveys/interviews. We use those inputs, along with the analyst’s experience and expertise in

Source: NICE & GWFM Research

Responses